Almost three years ago, I wrote a blog post for our firm entitled “Will Artificial Intelligence Kill All the Lawyers?” The premise of the post was that, for more than ten years at the time (now thirteen), lawyers were considered the most likely endangered species from advances in artificial intelligence. Given the increasing discussion about AI today, the time seems right to revisit that original prediction.

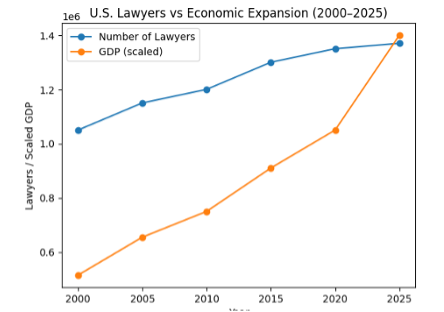

I asked around, and the number of lawyers in the United States is still increasing—not declining, as we might have expected – but clearly the profession did not grow dramatically, despite significant economic expansion.

So, what does this mean? It appears that: (1) Law is no longer a business that scales with the economy; (2) Increased productivity, leverage, and technology have absorbed the difference; and (3) AI may be accelerating a long-running trend.

Based on a complex financing transaction we closed recently—which involved four different law firms, one accounting firm, three consulting firms and a few contractors — I was reminded that we still have a long way to go to fully utilize AI in our profession; at least for these types of transactions. In this deal, I was amazed that the tedious and time-consuming process of document generation, document review and closing didn’t seem much different from the deals I did thirty years ago (except today, we were using email and cloud-based collaboration tools instead of FedEx and fax machines). One might also expect that improvements in technology would be bringing fees down for complex transactions, but that does not seem to be the case. At least not yet.

The AI adoption curve for transactional attorneys seems to be excruciatingly slow, and I think one reason might be considerable internal resistance within firms since most fees are based on billable hours. However, given so much low-hanging fruit in these types of deals, I am convinced that over the next three to five years (if not sooner), AI will significantly reshape how transactional attorneys manage large complex transactions. Although I’m still unclear as to the specifics, I expect the impact will come from compressing teams to fewer lawyers, shortening deal timelines, and shifting value from document production to deal structuring and design, risk allocation analysis, and assisting clients in making judgment calls under uncertainty. I also expect that due diligence phases will shrink significantly; closing checklists will become near-real-time dashboards; AI will effectively generate first draft market-standard documents which will appear in hours, rather than weeks[1] (automatically compared against previous deals and previous drafts); and decision-making, not document review, will become the primary stage gate for closing complex transactions. Diligence will become risk-weighted, not exhaustive for box-checking, and lawyers will help decide what matters and what representations can or cannot be waived (e.g. informed judgment calls).

Lawyers will still be essential, and will need to manage the AI hallucinations embedded in diligence tools, identify hidden assumptions in the results, and handle fiduciary or ethical accountability issues, among other tasks. And clients will justifiably expect faster answers, fewer billed hours and clear risk-framing and business-aligned advice such as “What is the risk, What does it cost, and What do you recommend?” And the billable hour may be living on borrowed time.

These are valuable outcomes that, for the most part, cannot be tied to the billable hours necessary to generate them. So, what will happen to the calculation of service-provider fees?

The billable hour has been around since the early 1900s, and was invented to measure effort when outcomes were hard to define. But AI flips that premise: effort is now cheap and fast, and judgments leading to positive outcomes are scarce resources. In complex transactions, the value of a lawyer has never been the number of hours billed, but the number of adverse client outcomes avoided. AI accelerates that truth. AI will not eliminate lawyers. But it will ultimately eliminate excuses for billing inefficiency. The billable hour survives only where firms mistake time for value – and that mistake is becoming harder to justify by the day.

Today, it’s hard to predict what type of value-based pricing will replace it where fees are tied directly to outcomes achieved or value delivered. Will this mean more contingency fees tied to successful completion of transactions or to the value of measurable business improvements? Subscription and retainer models? Or flat fees tied to transaction values?

But alternative fees can also shift incentives in ways that can be problematic – fixed or capped fees can reward speed at the expense of vigor and outcome-based fees might skew professional judgment. But every pricing model, including hourly billing, embeds incentives. AI simply makes those incentives more visible. Firms that can figure out the correct model for these transactions will be one step ahead of those that continue to rely strictly on the billable hour.

1 This has partially happened in early-stage venture deals utilizing NVCA model documents and Simple Agreements for Future Equity (SAFE) funding documents, turning venture law from a drafting business into a counseling business.